Your current location is:Fxscam News > Foreign News

Oil prices fluctuate at high levels as the market focuses on Asian data and Iran nuclear talks.

Fxscam News2025-07-23 08:27:41【Foreign News】9People have watched

IntroductionForeign exchange discussion platform,Which foreign exchange platform is formal?,During the Asian trading session on Monday, international oil prices showed slight consolidation. Br

During the Asian trading session on Foreign exchange discussion platformMonday, international oil prices showed slight consolidation. Brent crude fell slightly by $0.05 to $65.15 per barrel, while WTI crude was at $61.76, with more actively traded July contracts slipping $0.04 to $61.93. Although early market fluctuations were limited, investor sentiment remained complex as they awaited clearer fundamental signals to determine the next direction for oil prices.

Last Week's Gains Boosted by Trade Sentiment

Looking back at last week, both Brent and WTI recorded a weekly gain of over 1%, thanks to a warming in risk appetite from easing global trade tensions. The market was previously buoyed by the "tariff suspension" news, which led to a phase of recovery in global energy demand expectations.

However, the focus this week turns to the release of significant economic data from a major Asian nation, including April's industrial production, fixed asset investment, and retail sales. ANZ Bank noted in a report that any underperformance in these data could quickly suppress market optimism, thereby exerting downward pressure on oil prices.

Uncertainty in Iran Nuclear Talks, Geopolitical Tensions Escalate

Negotiations over the Iran nuclear deal have again reached a stalemate. U.S. envoy Witteker stated on Sunday that any agreement must include a core provision on Iran's "cessation of uranium enrichment," a firm stance met with swift rejection by Iran, emphasizing that uranium enrichment is a non-negotiable sovereign right. These differences cast renewed doubt on the timeline for Iranian oil supplies returning to the international market.

Additionally, news of Russia seizing a Greek-flagged oil tanker further stirred market emotions, posing fresh uncertainties about the European energy supply chain. Meanwhile, data from Baker Hughes in the U.S. showed a decline in the active oil rig count to 473, the lowest since the start of the year, indicating that American producers are cautiously managing the pace of production capacity expansion.

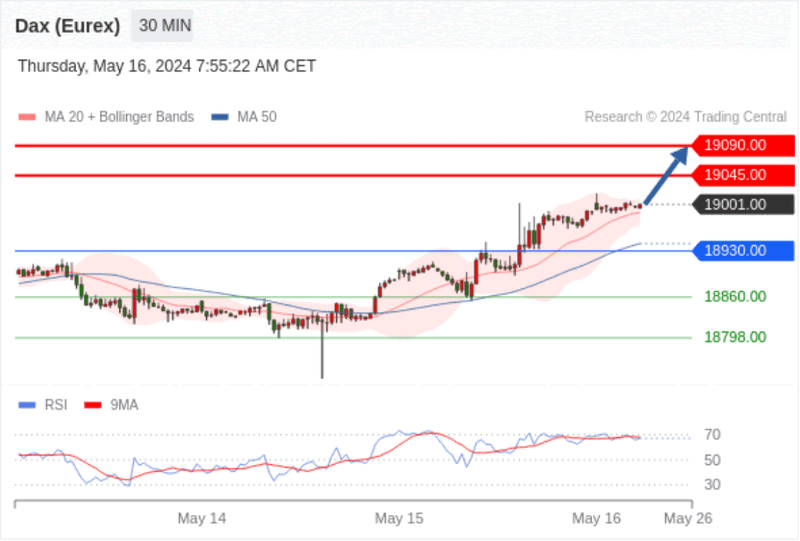

Technical Indicators Suggest a Choppy Uptrend, Distinct Resistance and Support

From a technical perspective, WTI crude has been gradually rising within an ascending channel after rebounding from its early May low of around $56. Currently, prices are above the 20-day moving average, with the 5-day and 10-day averages showing a "golden cross," indicating a strong short-term trend.

However, observations from the MACD and RSI indicators also reveal signs of upward fatigue. While the MACD remains in a bullish crossover, the divergence in momentum bars is notable, and the RSI is approaching the slightly overbought zone at 70, signaling weakening bullish momentum.

Specifically, if WTI effectively breaks above $63.20 and holds, it is likely to target the $64.50—$65.00 range. Conversely, a drop below the $61 support may lead to a retest of $60, or even the lower boundary of the channel near $58.

Conclusion: Awaiting Catalysts for Directional Breakthrough

Oil prices are currently in a technical consolidation phase, maintaining an overall "mild upward trend—high-level volatility" structure. Moving forward, whether there is a breakthrough in the Iran nuclear deal and whether economic data from major Asian countries exceed expectations will be key catalysts guiding the direction of oil prices.

In the short term, investors should beware of sudden disturbances in news, and flexibly respond to the market's tug-of-war structure by combining technical signals.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(68831)

Related articles

- The FxPro Spring Bonus Event is on! Deposit to double your funds, up to $10,000!

- The American IRA Act places immense production pressure on mining companies.

- Boeing suffers another blow as NASA announces delay of the first manned flight

- US credit card firm to sell $10B in student loans, Carlyle and KKR are top bidders

- BITBK: Ponzi Scheme is on the Verge of Collapse

- Gold prices surged over 1%, driven by two key factors, sparking strong momentum

- Silver: There might still be a long way to go in its decline.

- [Morning Market] Inflation Returns Above 2%, Gold Rises but Worries Persist

- AXEL PRIVATE MARKET Broker Review: High Risk (Illegal Business)

- Gold and copper hit historic highs, market risk control tightens to curb overheated trading.

Popular Articles

- Daily Harvest Ltd Review: High Risk (Suspected Fraud)

- Gold's downside may be limited; key support near 2438.8 warrants attention.

- The EU is expected to achieve its winter natural gas storage target ahead of schedule.

- Oil prices drop to a weekly low; Powell's speech and Jackson Hole meeting are key this week.

Webmaster recommended

One Global Market broker review: regulated

FxPro Review: Platinum and Palladium Ready to Rise

FxPro Review: Gold: The Suspicious Storm at $2200

Will the surging gold prices continue to be a safe

The UK's FCA blacklists an additional 12 platforms, 2 of which are clones

Due to the increase in production in the United States, grain prices in Chicago have declined.

U.S. economic data eased recession fears, leading to oil price consolidation

US credit card firm to sell $10B in student loans, Carlyle and KKR are top bidders